The corporate sector analysis of identifiers 935956477, 74450, 908000123, 281091, 613723231, and 2103665510 reveals crucial insights into the financial and operational aspects of the related enterprises. By examining revenue trends and profitability, one uncovers the strategies these businesses employ within their competitive landscapes. Understanding these dynamics is vital for stakeholders, yet the complexities of risk management and transparency present further considerations that merit attention.

Overview of Corporate Identifiers

Corporate identifiers serve as essential tools for distinguishing and categorizing businesses within the global market.

These identifiers enable stakeholders to access relevant financial metrics, facilitating informed decision-making. By providing unique codes and classifications, corporate identifiers enhance transparency and comparability, empowering investors to evaluate corporate health.

This systematic approach fosters an environment where freedom in commerce is supported by reliable data and clear identification.

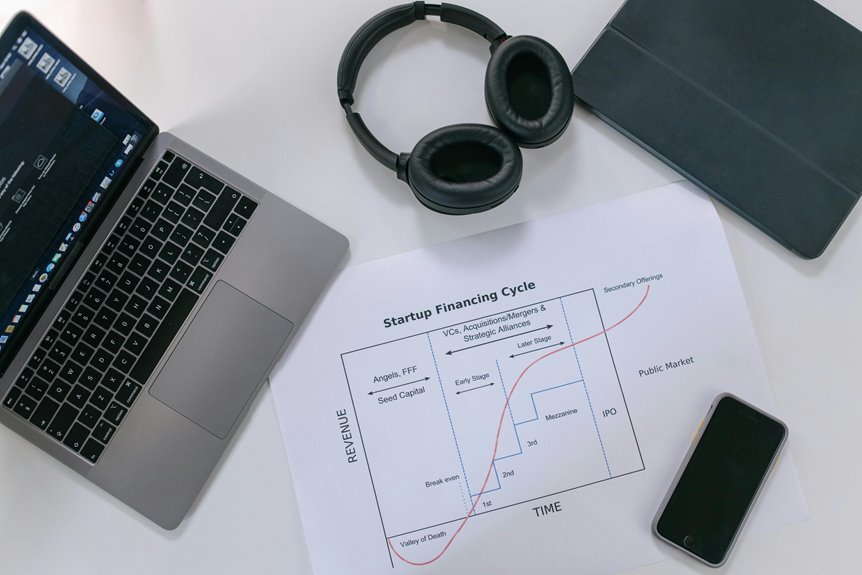

Financial Performance Analysis

Financial performance analysis involves systematically evaluating a company’s revenue, expenses, profitability, and overall financial health.

This evaluation utilizes financial ratios to provide insights into operational efficiency and market competitiveness. By examining revenue trends, stakeholders can identify growth patterns and potential areas for improvement.

Ultimately, such analysis serves to inform strategic decision-making and enhance the organization’s financial viability in a dynamic market landscape.

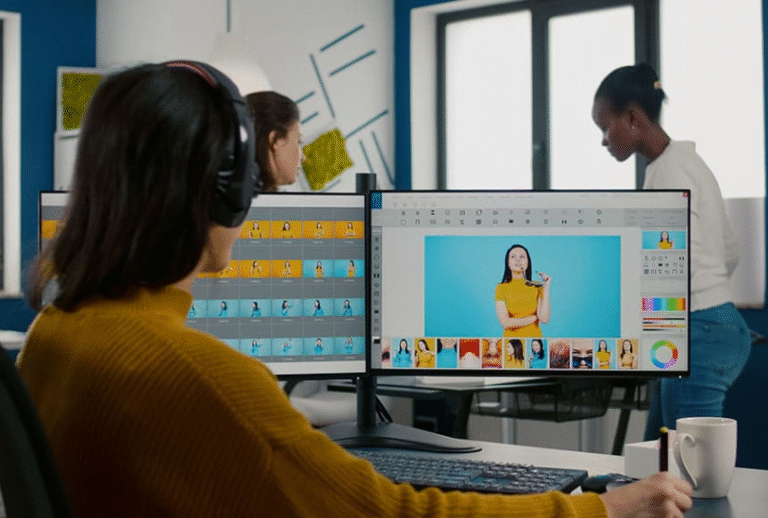

Operational Strategies and Market Positioning

Although many organizations prioritize financial performance, effective operational strategies and market positioning are equally critical for long-term success.

By understanding market dynamics, firms can enhance operational efficiency and achieve strategic alignment with customer needs.

Cultivating competitive advantages fosters customer engagement while incorporating robust risk management practices mitigates potential threats, ensuring resilience in fluctuating markets and contributing to sustained organizational success.

Insights for Investors and Stakeholders

As investors and stakeholders navigate an increasingly complex business landscape, understanding the underlying factors that drive company performance becomes essential.

Analyzing current investment trends reveals the importance of proactive stakeholder engagement, which fosters transparency and trust.

Conclusion

In summary, the synthesis of financial figures and strategic standings for identifiers 935956477, 74450, 908000123, 281091, 613723231, and 2103665510 showcases significant circumstances shaping the corporate sector. Stakeholders should seek to scrutinize these substantial statistics, fostering informed investment decisions. Ultimately, understanding these elements enhances engagement, ensuring a sustainable synergy between businesses and investors, thus paving the pathway for progressive performance and profitable partnerships in a competitive marketplace.